can you opt out of washington state long-term care tax

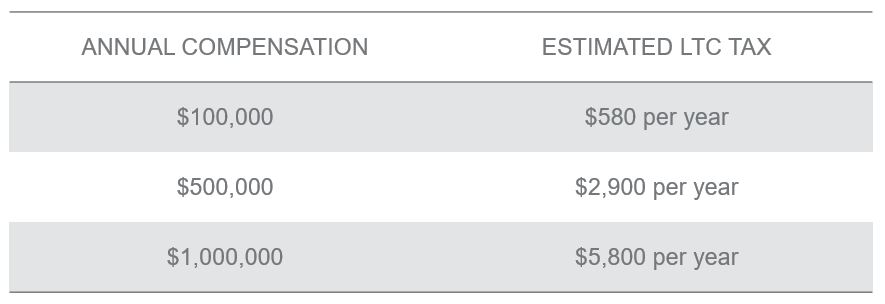

The tax is set at 058 and will automatically come out of your paycheck at an amount of 58 cents for every 100 of W2 income you earn and is subject to change beginning in 2024 and every two years thereafter. The video below will walk you through the opt-out process.

What Happened To Washington S Long Term Care Tax Seattle Met

Want to opt-out of Washingtons new long-term care tax.

. This money will cover. For someone with annual wages of 50000 thats 290 a year in premiums. Private insurers may deny coverage based on age or health status.

The current rate for WA Cares premiums is only 058 percent of your earnings. It will soon bring workers in our state a new payroll tax of 58 cents for every 100 of wages. The initial premium rate 058.

Long-term care policies must have been purchased by November 1 2021 to qualify for the exemption. Jay Inslee and other Democratic leaders requested the delay. A delay of the long-term-care law that mandates the program and its tax was secured in the passage of House Bill 1732.

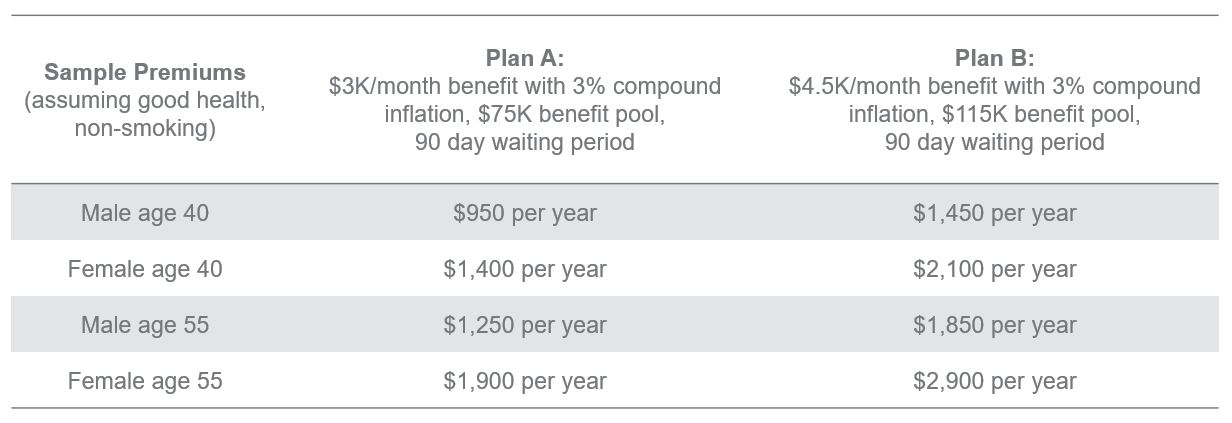

There is a new Washington State long-term care tax. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for an exemption from the program. Applying for an exemption.

But if you want to opt out you may have some trouble. An employee tax for Washingtons new long-term care benefits starts in January. The Window to Opt-Out.

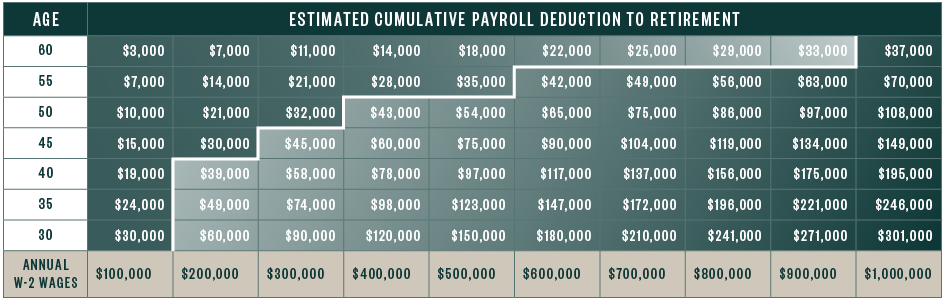

So as an example if you currently earn 100000 of W2 income you will be paying. The state does reserve the right to request proof of coverage in the future. There is a one time opt out for those who have eligible private long term care coverage elsewhere in place by November 1 2021.

The window to apply for an exemption occurs between October 1 st 2021 and December 31 st 2022. Washingtons new long-term care insurance tax charges. By providing a year of modest benefits 100 per day for 365 days the New York Long Term Care Trust Act will delay the need for Medicaid.

You can opt out if you show proof that you have long. Employers will not be required to collect the 58 payroll tax until July 1 2023. At the last minute they finally acknowledged that the long-term.

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. 1 2022 employers will begin withholding a new payroll tax from employee paychecks as a premium payment for the new long-term care benefit. In addition the law was updated so individuals born before January 1 1968 who have.

You must also currently reside in the State of Washington when you need care. Keep in mind that. You will not need to submit proof of coverage when applying for your exemption youll just need to attest that you have the required coverage.

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date before 1112021. Turns out they were a bit premature. Washington states Long-Term Care Trust Act is set to take effect at the beginning of 2022 and the only time to opt out of the new tax is fast approaching.

You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021. 509 396-0588 888 474-6520 8905 W. If you meet the opt-out criteria and purchased your LTC policy prior to Nov 1 2021 you have until December 31 2022 to opt-out of the tax.

An employee has a one-time opportunity to opt-out if they have comparable private long-term care insurance. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account. Update as of.

On January 27 th Governor Jay Inslee signed House Bill 1732 which delays implementation of the long-term care payroll tax in Washington State for 18 months. First to opt out you need private qualifying long term care coverage in force before November 1 2021. Can you opt out.

The employee must provide proof of their ESD exemption to their employer before the employer. If you have children in highschool or college who will be entering the workforce after the 1231. By slowing the growth of Medicaid this bill can help preserve the limited Medicaid budget for those who need it the most.

It will help to slow the growth of Medicaid. Washington has adopted a first-of-its-kind law that both provides a new long-term care benefit and pays for the new benefit with a new tax collected by employers. The Washington state House on Wednesday voted 91-6 to delay the implementation of the mandatory long-term care payroll tax by 18 months.

Good luck getting a private policy in time Aug 30 2021 at 719 am. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption. In that case the tax will be permanent and mandatory.

The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. An employee who attests they purchased long-term care insurance before November 1 2021 may apply for an exemption from the premium assessment. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage.

Washington employees who have coverage in place by this date can begin applying with Washington state to opt out of this insurance beginning October 1 2021 through December 31 2022. You will need to attest that you have purchased a private long-term care insurance policy before November 1 2021.

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

How Do You Opt Out Of Washington State S Long Term Care Tax Youtube

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Washington State Long Term Care Tax Here S How To Opt Out

Your Only Chance To Opt Out Of Washington S New Long Term Care Tax Is Fast Approaching Puget Sound Business Journal

Can You Opt Out Of The Washington Long Term Care Trust Act

Ltca Long Term Care Trust Act Worth The Cost

Time Expiring For Washington Residents In 30s And 40s To Avoid New Tax American Association For Long Term Care Insurance

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Long Term Care Insurance Washington State S New Law White Coat Investor

Kuow Washington House Votes To Delay Long Term Care Tax For 18 Months

What To Know Washington State S Long Term Care Insurance

-1.jpg?width=565&name=WA%20Trust%20Act%20Tax%20(based%20on%20salary)-1.jpg)

Washington State Is Creating The First Public Ltc Plan Who S Next

Faq Long Term Care Insurance Options In Wa Wa Long Term Care Coverage Options

Should You Opt Out Of The New Washington State Ltc Payroll Tax

Why To Consider Opting Out Of Washington State S Long Term Care Trust Act King5 Com

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Kuow Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time